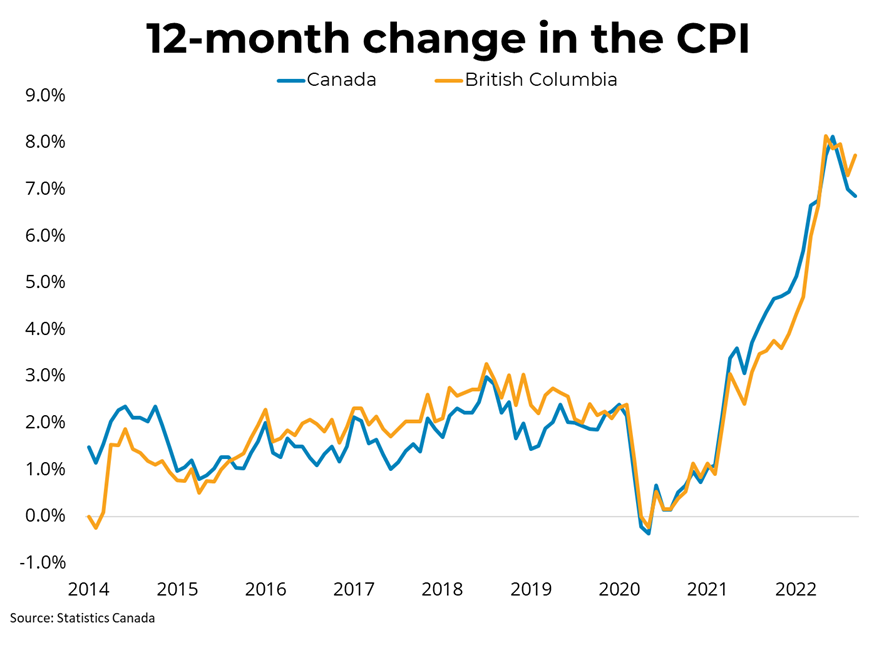

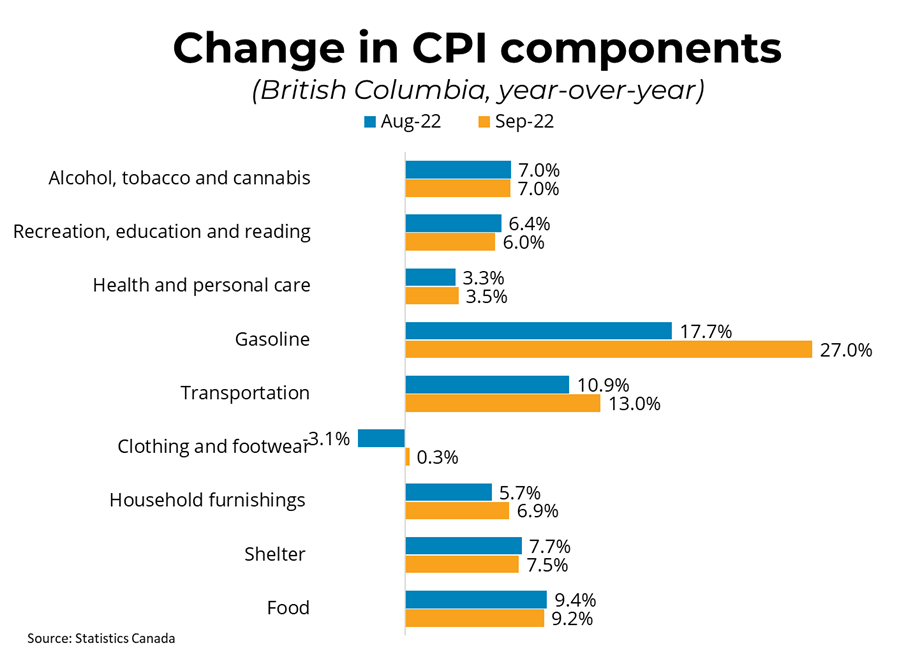

Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.9 per cent on a year-over-year basis in September, down from 7 per cent last month. This was the third consecutive month of decelerating price growth driven primarily by declining gasoline prices. Excluding energy, the CPI rose 6.3 per cent year over year in September, up from 6.1 per cent in August. Despite slower overall CPI growth, many subcomponents were still quickly appreciating, with prices for food purchased from stores (+11.4 per cent) growing at the fastest pace year-over-year since August 1981. Month-over-month, on a seasonally-adjusted basis, prices were up 0.4 per cent in September. In BC, consumer prices rose 7.7 per cent year-over-year, up from 7.3 per cent last month. This increase is because BC was the only province where gas prices rose from last month, partially due to multiple refinery shutdowns in the Pacific Northwest. Average hourly wages grew 5.2 per cent year-over-year in September, indicating a decline in purchasing power.

Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.9 per cent on a year-over-year basis in September, down from 7 per cent last month. This was the third consecutive month of decelerating price growth driven primarily by declining gasoline prices. Excluding energy, the CPI rose 6.3 per cent year over year in September, up from 6.1 per cent in August. Despite slower overall CPI growth, many subcomponents were still quickly appreciating, with prices for food purchased from stores (+11.4 per cent) growing at the fastest pace year-over-year since August 1981. Month-over-month, on a seasonally-adjusted basis, prices were up 0.4 per cent in September. In BC, consumer prices rose 7.7 per cent year-over-year, up from 7.3 per cent last month. This increase is because BC was the only province where gas prices rose from last month, partially due to multiple refinery shutdowns in the Pacific Northwest. Average hourly wages grew 5.2 per cent year-over-year in September, indicating a decline in purchasing power. September's CPI numbers continued to suggest that inflation may be slowing, despite certain areas such as food still rising in price at an increasing pace. The latest data show declines not just driven by falling gas prices, but softening in the rate of appreciation in core inflation including transport and shelter. However, core inflation remains well above the Bank of Canada's 2 per cent target and will need to decline significantly over the next several months before the Bank rethinks its current tightening policy. Bond yields are continuing to trend upwards, meaning that markets are still expecting an aggressive Bank of Canada singularly focused on bringing inflation back to its 2 per cent target.

Source - BCREA