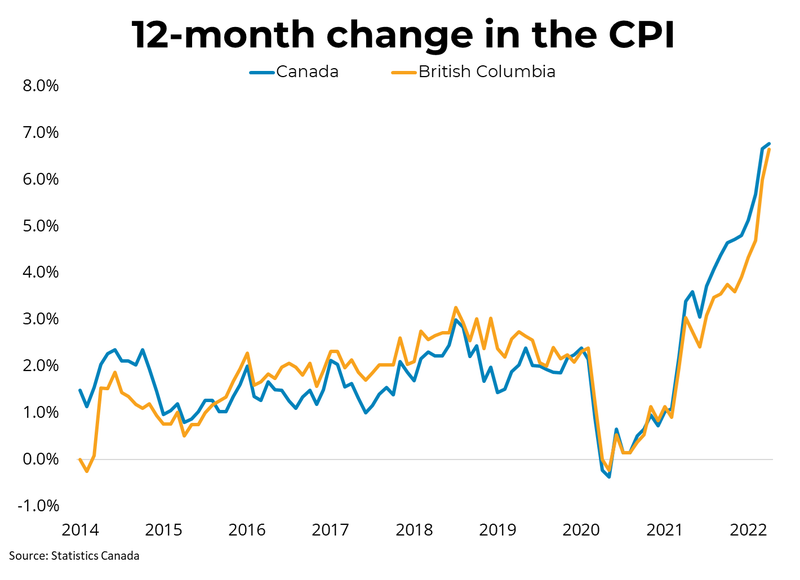

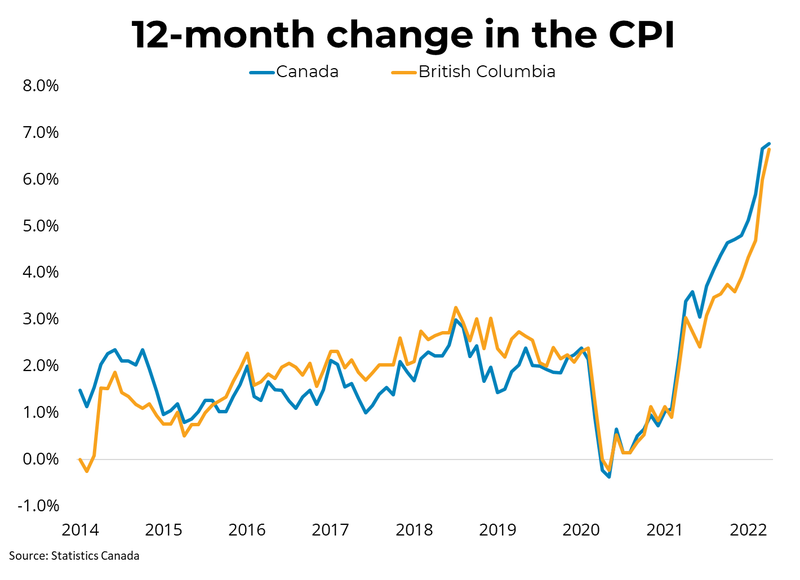

Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.8 per cent on a year-over-year basis in April, up from 6.7 per cent last month. This was the largest gain since January 1991 (+6.9 per cent). According to Statistics Canada, price rises were broad-based, with groceries up 9.7 per cent year over year, gasoline up 36.3 per cent, and shelter costs up 7.4 per cent. Excluding gasoline, the CPI rose 5.8 per cent year over year in April. On a monthly basis, prices were up 0.6 per cent, moderating from a 1.4 per cent increase in March. In BC, consumer prices rose 6.7 per cent year-over-year.

Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.8 per cent on a year-over-year basis in April, up from 6.7 per cent last month. This was the largest gain since January 1991 (+6.9 per cent). According to Statistics Canada, price rises were broad-based, with groceries up 9.7 per cent year over year, gasoline up 36.3 per cent, and shelter costs up 7.4 per cent. Excluding gasoline, the CPI rose 5.8 per cent year over year in April. On a monthly basis, prices were up 0.6 per cent, moderating from a 1.4 per cent increase in March. In BC, consumer prices rose 6.7 per cent year-over-year. With inflation stubbornly high through the first part of 2022 and unemployment in Canada hitting a record low, the Bank of Canada is now planning to bring its policy rate back to a neutral level, between 1.75 and 2.75 per cent, much faster than previously anticipated. We expect the Bank will continue to tighten until there is clear evidence that inflation and inflation expectations are moderating back to normal levels. This more aggressive policy stance has already been priced into 5-year fixed mortgage rates, which are now above 4 per cent for the first time in a decade.

SOURCE: BCREA

SOURCE: BCREA